SAN FRANCISCO—Advanced Micro Devices Inc. (AMD), which has seen its sales decline over the past several years and has reported six consecutive quarterly losses, slipped out of the top 20 semiconductor vendors as ranked by sales in the first half of 2015, according to market research firm IHS.

AMD’s slip in the rankings was largely due to a particularly rough second quarter, when the company’s sales declined by 35% compared with the second quarter of 2014, IHS (Englewood, Colo.) noted. The second quarter also marked the first time AMD’s sales slipped below $1 billion since 2003, IC Insights added.

AMD has been ranked among the top 20 chip suppliers in every calendar year since sometime prior to 2000, according to annual rankings issued by iSuppli Corp.(now part of IHS Inc.)

AMD has been undergoing turbulence in recent years amid declining sales and a lull in the PC market, which until recently accounted for about 90% of the company’s sales. AMD has demonstrated progress in recent years increasing the percentage of its revenue it derives from non-PC markets and the company’s CEO, Lisa Su, has pledged a return to profitability in the second half of this year.

But IC Insights noted that AMD’s restructuring and focus on non-PC markets has yet to pay off. The firm noted that AMD lost $361 million in the first half of this year and $403 million in 2014.

Brian Matas, vice president of market research at IC Insights, said in an interview that AMD’s efforts to gain share in enterprise and embedded markets and develop ARM-based processors alongside x86 products have yet to pan out. The continuing decline in PC sales has not helped.

”Nothing has really worked out [for AMD] so far,” Matas said.

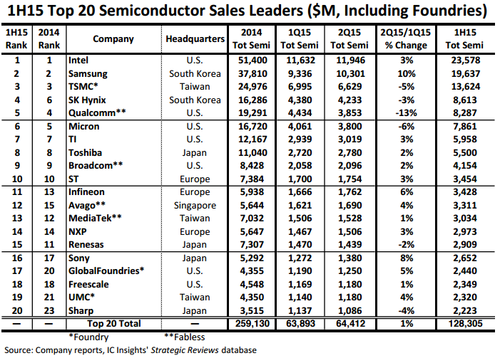

To no one’s surprise, Intel Corp. remained the largest semiconductor company in the first half of 2015 with sales of $23.6 billion. Intel has been the world’s biggest chip maker since 1992.

Samsung Electronics Co. Ltd., which has been the No. 2 ranked chip supplier since 2001, comfortably retained that standing in the first half of 2015, according to IC Insights. But the firm noted that Samsung cut into Intel’s lead based on strong growth in the second quarter. Samsung recorded first half chip sales of about $19.6 billion, about 16% lower than Intel’s sales, IC Insights said. In 2014, Intel’s sales were 36% higher than Samsung’s, according to the firm.

Samsung had the highest growth rate in the first half among companies in the top 20, 10%, IC Insights said. Qualcomm had the worst first half among the top 20 firms, posting a 13% decline in sales, IC Insights said. The firm noted that Qualcomm is on pace to post a semiconductor sales decline of 20% in 2015.

But IC Insights said Samsung is unlikely to pass Intel in chip sales in the near future. The firm noted that Intel has estimated that its third quarter sales will be up 8% compared with the third quarter of 2014 and that Samsung is facing a lackluster DRAM market due to pricing pressure.

Chip sales from the top 20 suppliers increased cumulatively by just 1% from the first quarter to the second quarter, the same percentage as the overall semiconductor industry.

Japan’s Sharp Corp. and Taiwanese foundry United Microelectronics Corp. (UMC) were new entrants in the top 20 ranking in the first half, IC Insights said. These companies displaced AMD and Nvidia Corp. on the list.

The top 20 chip ranking is part of an August update to IC Insights’ McClean Report.